Tips Deflation Floor

At maturity a tips investor receives the higher of the adjusted principal value or the original.

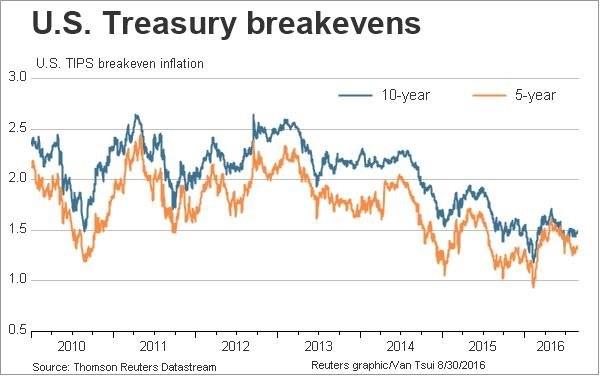

Tips deflation floor. Treasury inflation protected securities or tips provide protection against inflation. Another risk i associate with tips is the risk of deflation a general decline in prices the opposite of inflation. In other words if the consumer price index is. Tips come with a deflation floor that protects the holder s principal value if the depression scare turns into a deflationary episode.

The limited treasury outperformance during deflation is because tips have a deflation floor. The possible boost to real ytm comes from the par floor feature in all tips. What happens to tips if deflation occurs. The principal is adjusted downward and your interest payments are less than they would be if inflation occurred or if the consumer price index remained the same.

Risks of investing in tips. Treasury inflation protected security tips is a treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money. The possible boost to real ytm comes from the par floor feature. United states treasury will pay the deflation adjusted principal at maturity or the face value whichever is higher.

At maturity if the adjusted principal is less than the security s original principal you are paid the original. If you buy tips with short maturities like a 5 year tips it s possible to have deflation for 5 years. If there is net cumulative deflation between the date the bond was originally issued and the date the bond matures you will be paid more than the. Falling prices and decreasing asset values are symptoms of economic deflation.

When a tips matures you are paid the adjusted principal or original principal whichever is greater. Tips offer unlimited potential outperformance over treasuries in inflationary environments while regular treasuries only offer limited potential outperformance over tips in deflationary environments. However the risk is still considerable because there are older tips issues carrying years of inflation adjusted accruals which can. Treasury sets an initial floor for tips at par value.

As the economy slows demand for goods and services drops and employees are laid off as production slows. If there is net cumulative deflation there s a chance your real ytm can increase but it will never go lower than what you were quoted when you bought the bond.