Universal Credit Minimum Income Floor Covid 19

8 72 x 35 305 20 per week.

Universal credit minimum income floor covid 19. The more you earn over the minimum income floor the less your universal credit payment will be. This took effect on 13 march 2020 for new applicants and will last for the duration of the outbreak. His minimum income floor for any assessment period using current figures should therefore be. The minimum income floor relaxation will apply from 6 april 2020 for.

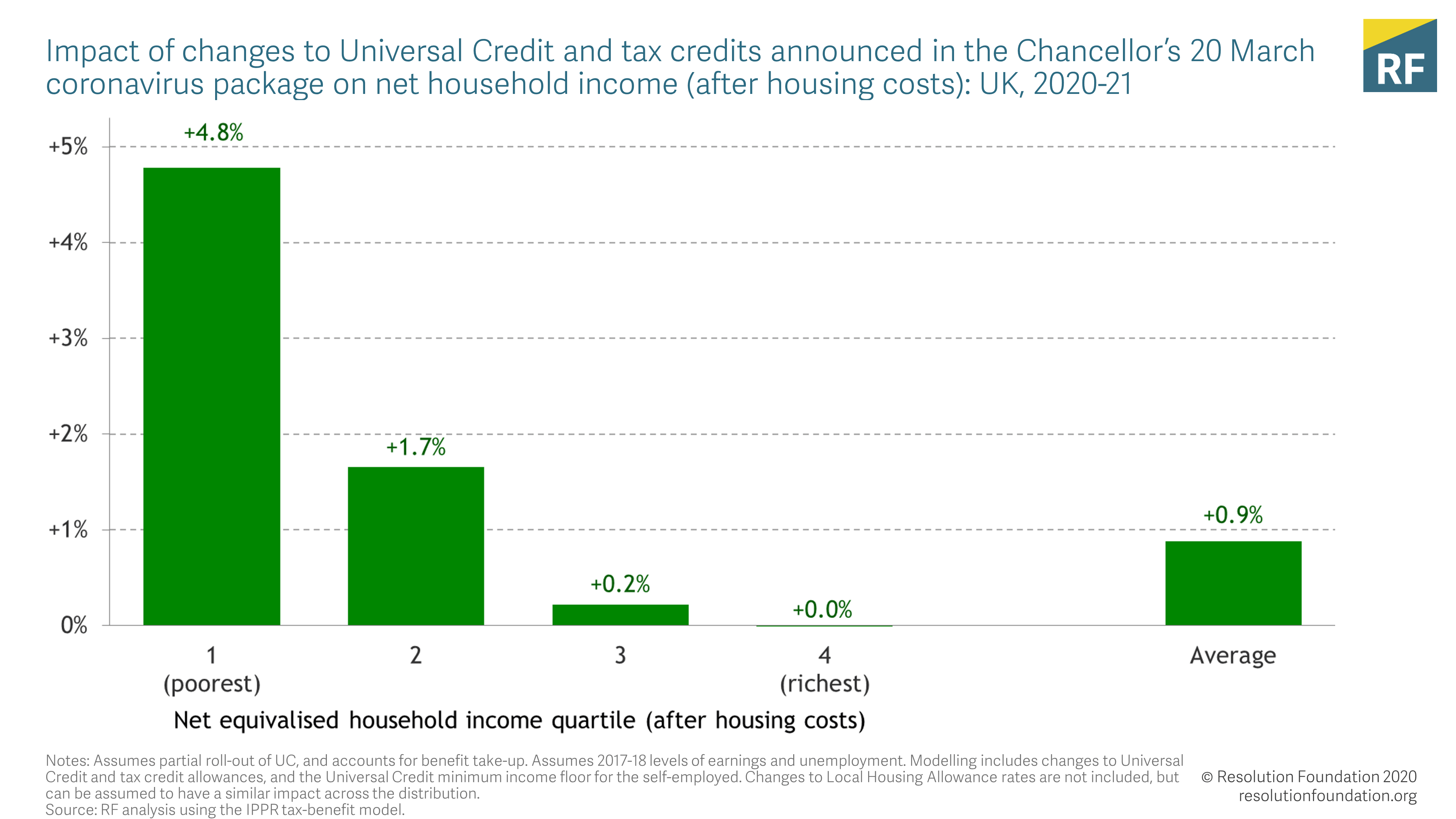

Temporarily removing the universal credit minimum income floor. Since 30 march 2020 the way your universal credit payment is worked out has changed because of coronavirus covid 19. Universal credit includes a minimum income floor mif if you are gainfully self employed and your business has been running for more than 12 months. The government has also temporarily suspended jobcentre visits for those who have to self isolate due to the covid 19 outbreak.

A self employed worker aged 25 working full time would previously be assumed to be earning at least about 1 310 mth. The minimum wage for the number of hours the claimant is expected to work is based on the national minimum wage of 8 72 an hour for a 35 hour week. Minimum income floor suspended for coronavirus victims budget 2020 universal credit has seen a radical shake up in the new budget as announced by rishi sunak yesterday. The basic rule is for every extra 1 you earn your universal credit will go down by 63p.

If you earn less than your minimum income floor. The mif is an assumed level of earnings based. Now without the minimum income floor in place you can earn less than this and the amount of universal credit you get will be boosted. Your payment will be worked out as if you d earned the minimum income floor amount.

His individual earnings threshold i e. Payments are no longer calculated using an assumed level of earnings called. The mif is an.