Universal Credit Minimum Income Floor Exemptions

Universal credit is a new welfare scheme available to those who are unemployed or on a low income.

Universal credit minimum income floor exemptions. An amount for income tax class 2 and class 4 national insurance contributions is then deducted to arrive at your monthly minimum income floor. It can be paid to those who are self employed including claimants who decide to start their own. The more you earn over the minimum income floor the less your universal credit payment will be. If your business is less than 12 months old the minimum income floor won t apply to you for one year.

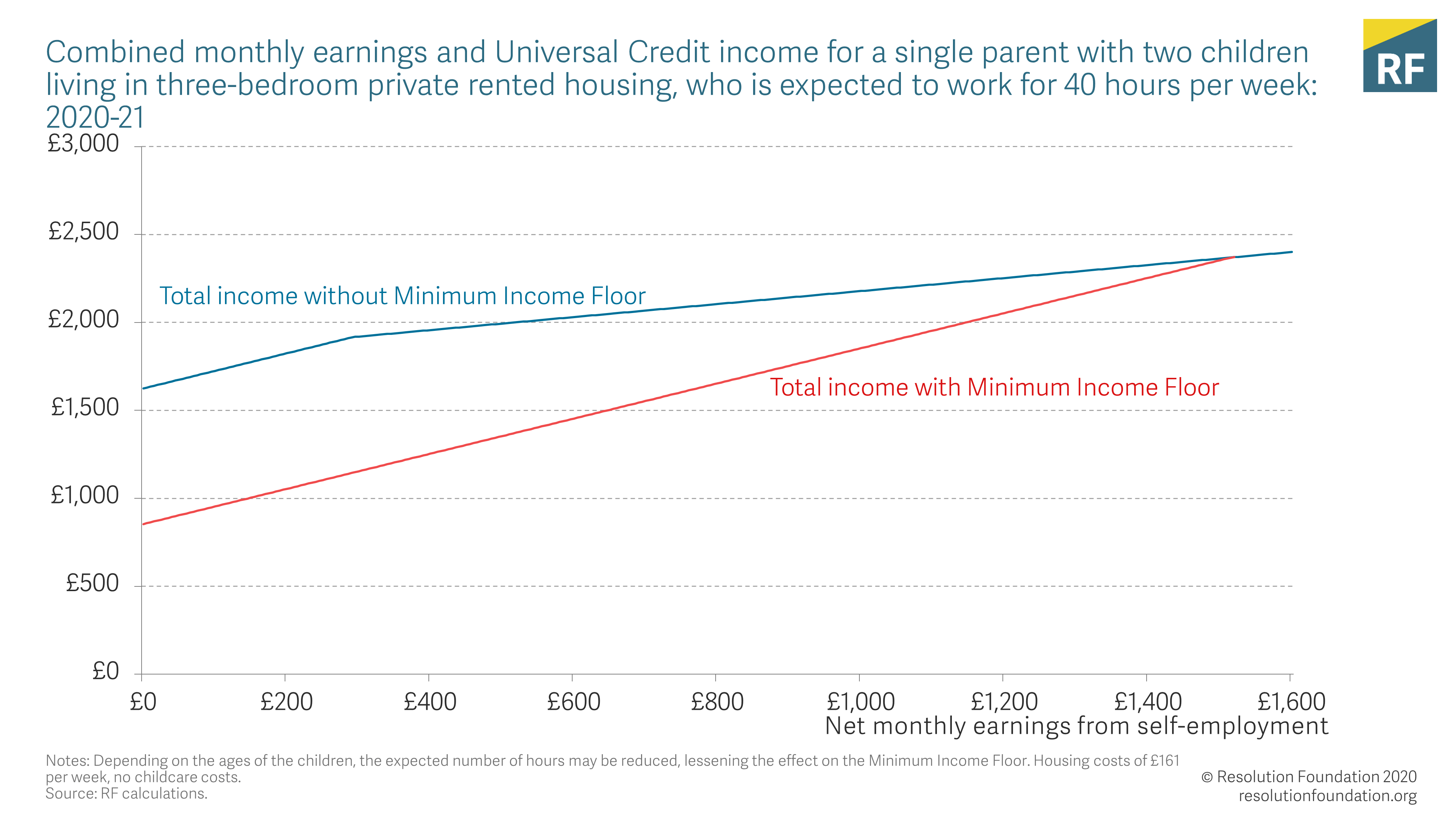

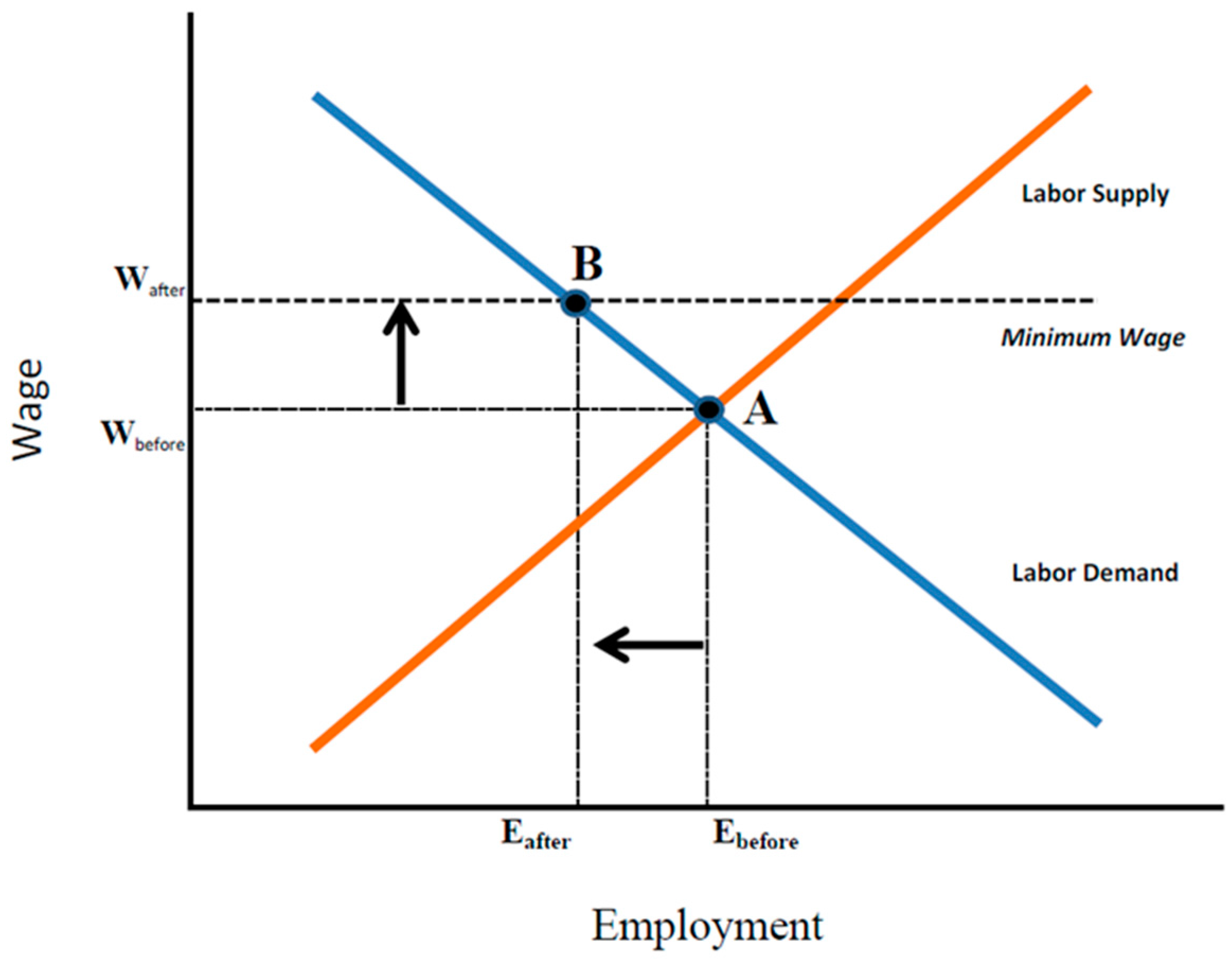

The mif is an assumed level of earnings. 1 these regulations may be cited as the universal credit childcare costs and minimum income floor amendment regulations 2019. However unlike claimants looking for standard work as an employee the self employed will have their uc entitlement pegged to a minimum income floor mif. If you earn more than the minimum income floor you will get less universal credit.

This is an assumed level of earnings that for most workers will be the equivalent to the national living wage. If the minimum income floor doesn t apply to you your universal credit payments will be calculated on your actual income rather than your assumed income. 2 this regulation and regulation 3 come into force on 3rd october 2019. 8 72 x 35 305 20 per week.

In regulation 33 of the universal credit regulations 2013. If you are moved onto universal credit through managed migration the minimum income floor won t apply for the first 12 months of your universal credit claim. The minimum wage for the number of hours the claimant is expected to work is based on the national minimum wage of 8 72 an hour for a 35 hour week. His individual earnings threshold i e.

3 regulation 2 comes into force on 16th october 2019. Your payment will be worked out as if you d earned the minimum income floor amount. His minimum income floor for any assessment period using current figures should therefore be. Exemptions from the minimum income floor.

Universal credit includes a minimum income floor mif if you are gainfully self employed and your business has been running for more than 12 months. The basic rule is for every extra 1 you earn your universal credit will go down by 63p.